“This time is different”: The past 2 weeks have brought hysteria to global stock markets, concerned over the daily spread of the coronavirus. The advisors at Ironwood want to provide guidance and leadership during times like these; and to remind our clients the importance of remaining disciplined, by avoiding impulsive investment decisions based upon uncertainty and fear. During challenging periods investors often operate under the mindset that “this time is different” – which is indeed true. Every stock pullback has been triggered by circumstances which were different than the past, yet the long-term results have remained the same: markets power through times of uncertainty, ultimately returning to pre-panic levels. But time and time again, behavioral finance studies have shown that humans are not efficient in learning from our past mistakes. While it’s natural to be feeling anxious about the market’s recent selloff, the best practice is to resist acting upon it. Ironwood’s advice is to remain resilient, by continuing to hold a diversified portfolio of assets, and staying focused on your long-term goals and the plan we have in place to achieve them.

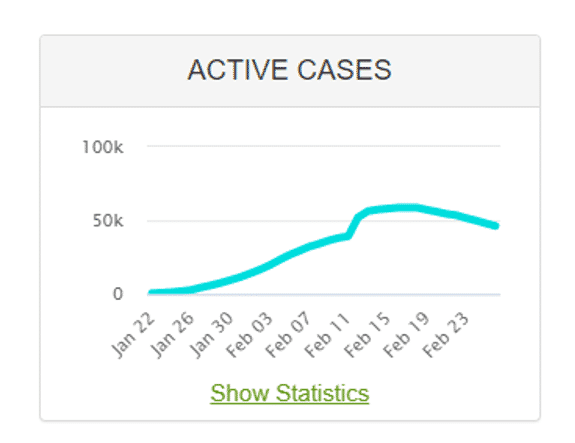

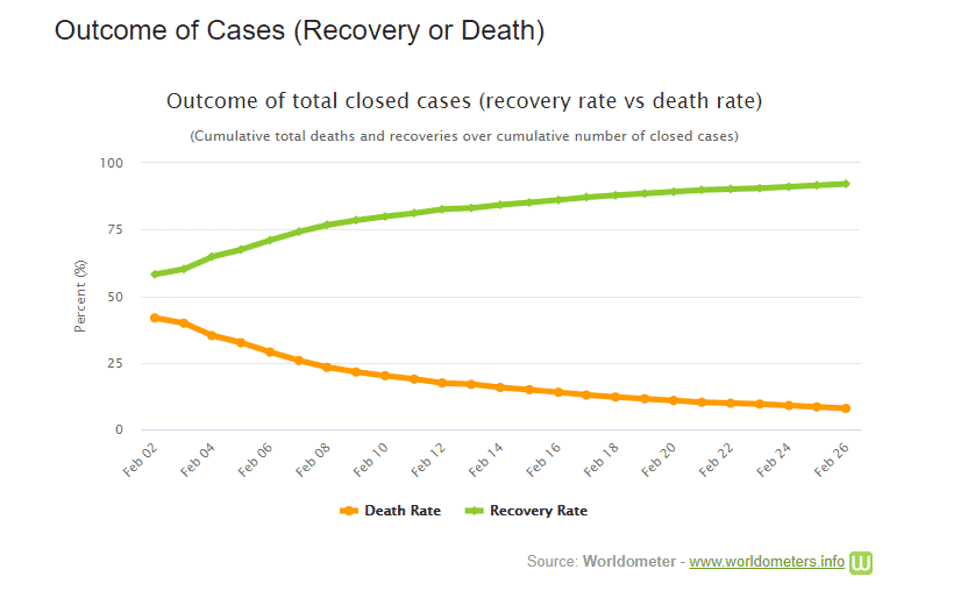

Focusing a bit on the coronavirus: A single death resulting from the novel coronavirus is too many – but to provide some perspective, the World Health Organization reports there have been at least 15 million flu illnesses, 140,000 hospitalizations and 8,200 deaths during the 2019-2020 flu season alone. Imagine if companies and investors made long-term financial decisions based upon on a case-by-case and hour-by-hour spread of the annual flu! While they are differences between this coronavirus and seasonal influenza (in terms of the mortality rate and vaccine readiness), we encourage client to keep the current coronavirus outbreak in perspective. There are signs that the number of global active coronavirus cases have peaked (Worldometer), and that our ability to fight the virus is improving with each passing day (see chart below). Furthermore, there is a coordinated global effort underway to develop a novel coronavirus vaccine and to slow the spread of infection. “What is exceptional about this outbreak is the Chinese shared the sequencing of the virus, for the first time, and this is wonderful,” Ilaria Capua, director of the One Health Center of Excellence at the University of Florida-Gainesville says, “We now have the collective intelligence to get ahead of a problem like a new virus, which is no longer as we’re seeing just a problem of one country anymore.”

Supply-side earnings pressure: From an economic perspective, the real question is the impact of the coronavirus virus on corporate earnings around the globe. Ironwood believes the virus will have a large impact on second quarter numbers, however, the cause will be more supply driven versus demand driven. If an earnings drop is the result of limited supply, we anticipate a stronger second half of the year making up for the disruption we may see in early 2020. Put another way, this means earnings pressures will be more transitory in nature and like many economists, predict a V-shaped rebound in the second half of the year. Ironwood encourages our clients to stay-steady, with an understanding that the US economy remains strong, driven by record-low unemployment, a firm housing market and robust consumer spending.

When market volatility creates opportunity: With aggressive asset classes pulling back 10%-15%, we believe this scare has become overdone. Ironwood sees the recent market volatility as a long-term buying opportunity for those with cash on the sidelines. It is essential to avoid panic, and to remain focused on the long term. And it pays to remember that while volatility brings a certain amount of uncertainty to the markets, it also brings opportunity. In order to generate higher long run returns, investors must go further down the risk spectrum. When taking more risk, short term pullbacks are an inevitability. Now is a good time to remember that the average intra-year pullback of the S&P 500 13.8% (looking at the past 40 years of data), yet the S&P 500 has an annual total return of roughly 8.9%.

The power of diversification and allocation among low-correlation asset classes: Equity markets could easily drop further from current levels. Unpredictable volatility is exactly why our retired clients (or those approaching retirement) have a healthy percentage of their investment accounts allocated to safer assets. Safer, lower volatility positions tend to have a low-correlation with aggressive assets – meaning they can act as a buffer (and source for retirement cashflow), allowing more aggressive portfolios assets time to recover from short term pullbacks.

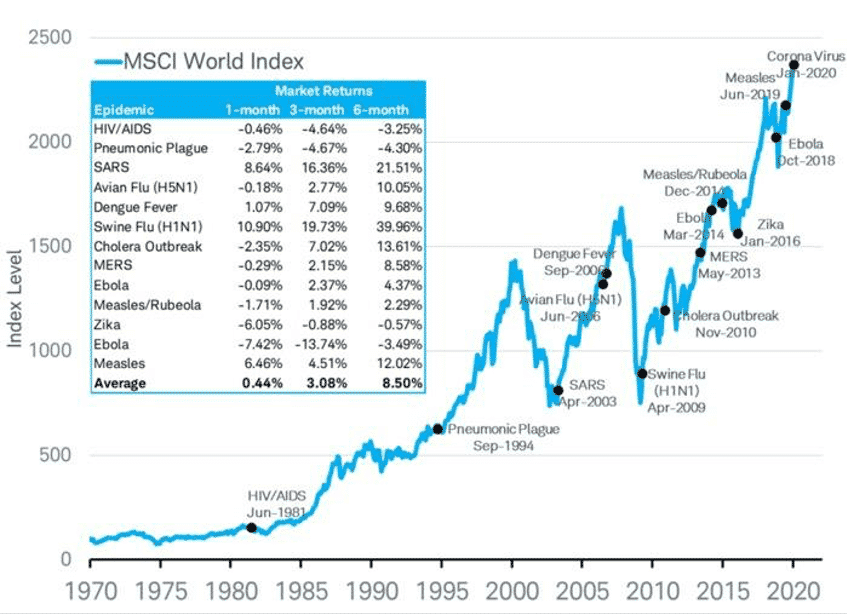

This too shall pass: There have been many viral outbreak scares in the recent history, many of which have triggered a negative short-term stock market reaction (see chart below). It is critical to remember that while each of these outbreaks brought fear and panic to investors, they eventually all passed. And following the periods of selloff, the market soon returned to its previous pre-panic levels. While it appears that the 2020 novel coronavirus may stunt economic growth over the short run, successful investors must resist the urge to panic.

Ironwood is here to help: If you are concerned about the recent stock market volatility or would like to discuss the impact on your long-term plan, please contact your Wealth Advisor at Ironwood Wealth Management.