2020 has been a wild ride, thanks to the snowballing effects of the coronavirus: the back-and-forth freezing and restarting of economic activity, major shifts in monetary and fiscal policy, low interest rates, the potential for higher inflation, not to mention the risks of an uncertain election season.

With all that in mind, here’s our mid-year look at the investment landscape.

Trend: Bifurcation in the market is causing heady enthusiasm for growth stocks.

We’re seeing a deeper divergence between companies that have weathered the COVID-19 storm well and those that have been less successful.

What’s doing well: Growth stocks, especially those in tech (think the usual suspects of Microsoft, Amazon, Google, and Apple). “These are companies where the bottom line is not impacted all that much when people work from home,” says Cean Rogers, CFA, CFPⓇ, AIFⓇ, and CEO and founder of Ironwood Wealth Management.

What’s hurting: Anything to do with travel or vacationing, including airlines and hospitality.

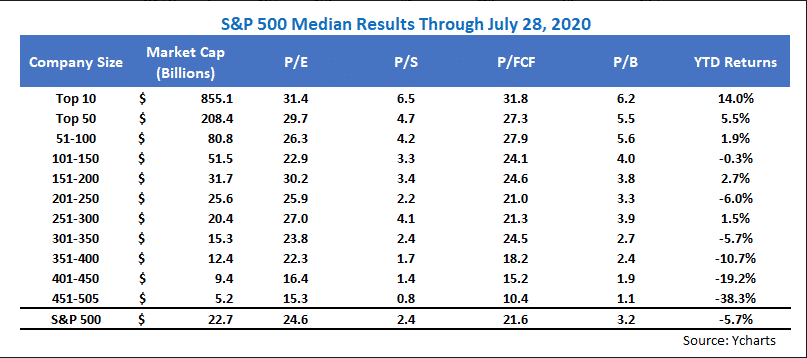

As of July 28, the top 10 companies in the S&P 500 represented nearly 30% of the market cap and YTD returns were 30%. Notably, the top six are all tech companies. The remaining 490 S&P 500 companies are down 6% in contrast. “If you look at the valuations of those top 10 companies, you’re starting to see valuations that are at elevated levels. We’re trending toward 1999-type valuation metrics: 30+ P/E ratios and price to book over 6,” Cean says.

Given the low treasury bond rates of the moment, investors are fleeing bonds for more aggressive asset classes, like stocks. The 10-year treasury bond started 2020 at just under 2% and has tumbled to .55% — significantly lower than the long-term average of 4.44%.

“It’s forcing investors of all sorts to say, ‘60 basis points for the next 10 years is not going to cut it.’ That’s probably not even going to come close to outpacing inflation,” Cean says. “So right now, investors are willing to pay up for growth, and it’s getting a little out of hand. In fact, we’re starting to see a bit of breakdown in some of these growth stocks. It’s still early, but we’re seeing more volatility in that segment — especially each day that we receive updated vaccine data. These growth stocks are working because they are very prepared for current conditions; however, they have been very popular and are now at valuations that, in our opinion, are a bit stretched. If we get a vaccine sooner than expected, these companies could quickly go from 30 P/E multiples to 20. That would be a 33.33% decline in stock prices, if nothing else changes.”

The best course of action is to make sure you’re diversified. “You can’t just put a lot of your eggs in the top 10 companies of the S&P 500,” Cean says.

Trend: With a depreciating dollar, emerging and international markets and credit are more attractive.

Talk of miserable T-bond yields brings us to the next trend: The way the United States has handled the coronavirus has impacted us — and our dollar — more than other countries around the world.

The Federal Reserve’s commitment to aggressive monetary stimulus has been unprecedented. The speed and force with which they acted in March, in our opinion, thwarted major pain that would have otherwise ensued. Witness the $3 trillion CARES Act, and they’re currently negotiating spending between another $1 and $3 trillion on CARES Act, part 4.

When aggressive government spending like this occurs, a few things happen: the dollar depreciates; precious metals do well; and international stocks and bonds tend to do well for U.S. investors who are U.S. based.

The U.S. has dominated stock performance for the better part of the last decade, but in the last month or so, we’re seeing developed international and emerging markets start to outperform, driven by the depreciating dollar.

In addition, the credit market has stabilized. “Our Federal Reserve has expanded the balance sheet tremendously and has explicitly said they’re going to do whatever they need to do for as long as is needed. This backstop has kept credit markets very liquid, which has allowed companies in beaten-up spaces to get credit. As an example, it allowed Boeing — in an industry that’s totally being gutted by the coronavirus — to issue $25 billion in loans (seven different tranches) at around 5% interest rate,” Cean says.

This unprecedented backstopping of the credit markets by the Fed has calmed credit markets and made investors more comfortable with corporate bonds.

Curious about how these trends might affect your own investment outlook? Schedule some time to meet with a wealth manager at Ironwood Wealth Management today.